Tusshar Kapoor Real Estate Investment Insights

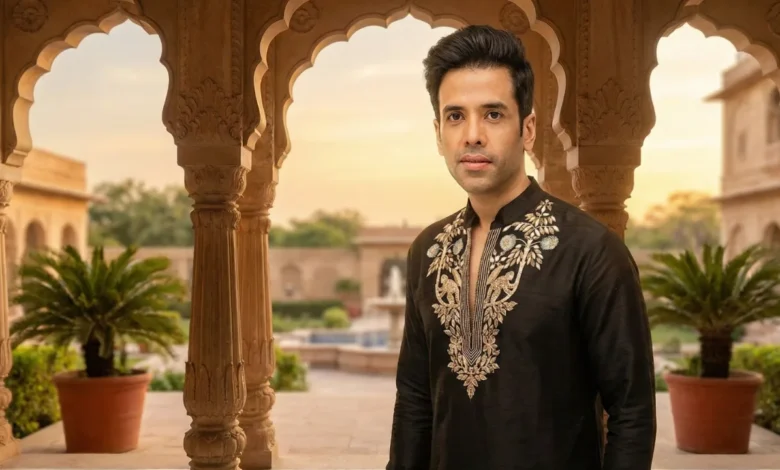

At a recent brand launch event, Tusshar Kapoor’s candid views on property investments, affordable housing, and smart cities highlighted how Indian investors are prioritising stability, practicality, and long-term growth.

-

Kapoor prefers real estate over stocks or film investments for stability

-

Affordable and ready-to-move homes remain top choices for buyers

-

Smart Cities and emerging markets like Pune seen as future growth hubs

Celebrity investment conversations in India are no longer limited to film production houses or stock portfolios. Increasingly, they are turning toward long-term asset creation, particularly real estate. Actor Tusshar Kapoor recently shared candid insights into his property preferences during a rapid-fire interaction with entrepreneur Mayank Agarwal at the launch of Agarwal’s new venture, The House of Jets.

What stood out was not just Kapoor’s personal taste, but how closely his views align with the evolving mindset of India’s modern property investor.

Choosing Stability Over Glamour

In a straightforward choice between Bollywood, the stock market, and real estate, Kapoor leaned toward property investment. His reasoning reflected a wider investor belief — that real estate offers tangible value and relatively stable long-term appreciation compared to market volatility.

This sentiment mirrors what financial advisors often highlight: while equity markets can deliver high returns, they also come with higher fluctuations. Real estate, particularly in growing urban corridors, is perceived as a physical, income-generating asset with capital appreciation potential.

Kapoor also noted that cities like Pune could currently offer stronger growth opportunities than Mumbai. This aligns with a broader industry narrative where emerging cities, backed by infrastructure expansion and affordability advantages, are attracting both end-users and investors. With better connectivity, IT hubs, and lifestyle developments, tier-2 growth corridors are increasingly becoming investment hotspots.

Practical Housing Decisions Reflect Market Demand

One of the most telling aspects of the interaction was Kapoor’s preference for affordable housing over ultra-luxury developments. While premium properties generate headlines, affordable housing continues to drive the bulk of India’s residential demand.

For developers and investors, this reinforces a critical reality — the mid-income and affordable segments form the backbone of the housing market. With government incentives, infrastructure push, and rising urbanisation, this category remains resilient even during economic slowdowns.

Kapoor also expressed a preference for ready-to-move-in homes rather than under-construction projects. This choice resonates strongly with today’s buyers, who often prioritise:

-

Immediate possession

-

Reduced construction risk

-

Greater financial clarity

-

No uncertainty regarding delivery timelines

In recent years, regulatory reforms such as RERA have improved transparency in under-construction projects, yet many buyers still prefer completed properties for peace of mind. Kapoor’s choice reflects this cautious yet practical approach.

Lifestyle Preferences Driving Premium Demand

While practicality dominated his investment logic, Kapoor also acknowledged lifestyle aspirations that are shaping premium housing demand. He mentioned a liking for sea-facing apartments and scenic hill villas — two formats that have gained traction in India’s luxury and second-home markets.

Urban waterfront living remains aspirational in metro cities, while tranquil hill destinations are increasingly sought after for holiday homes and remote-work flexibility.

Interestingly, Kapoor highlighted the importance of a gym as his favourite building amenity. This reflects a significant shift in buyer expectations. Post-pandemic, wellness-driven amenities such as gyms, yoga decks, jogging tracks, and open green spaces have become key selling points in residential projects.

His personal routine — reading with coffee at home — subtly underlines another housing trend: the desire for functional, comfortable personal spaces. Homes are no longer just sleeping quarters; they are workspaces, leisure zones, and wellness hubs combined.

Smart Cities and the Future Outlook

Despite his tilt toward property, Kapoor acknowledged that reading film scripts remains emotionally engaging — a reminder that investments and passions can coexist. However, when discussing future real estate growth, he pointed toward India’s Smart Cities rather than naming a single dominant metro.

This view reflects industry consensus. Infrastructure-led urban transformation — including metro networks, expressways, tech parks, and smart governance systems — is reshaping property markets. Cities benefiting from planned development and digital infrastructure are likely to attract sustained investor interest.

Kapoor also emphasised a universal principle: consistent hard work delivers results — whether in cinema or real estate. For investors, this translates into disciplined planning, due diligence, and long-term holding strategies.

What Investors Can Learn

Tusshar Kapoor’s real estate investment perspective offers several takeaways for homebuyers and investors:

-

Think Long-Term: Real estate remains a stable asset when held with patience.

-

Prioritise Practicality: Affordable and ready homes often deliver steady value.

-

Track Infrastructure Growth: Emerging cities can outperform saturated markets.

-

Focus on Lifestyle Amenities: Wellness and usability now influence property value.

His views echo the mindset of India’s new generation of investors — those who prioritise stability, transparency, and long-term urban growth over speculative glamour.

As India’s property market continues to mature, celebrity endorsements may grab attention, but it is grounded, practical decision-making that ultimately shapes sustainable wealth creation.

Also Read: Reliance MET City Launches 100-Acre Mixed-Use Project ‘Metropolis’ in Haryanad

Also Read: Sonu Sood Leases BKC Commercial Unit to HDFC Bank at ₹11.75 Lakh Monthly Rent