GST Notices to Noida Societies Spark Panic Over Maintenance Charges

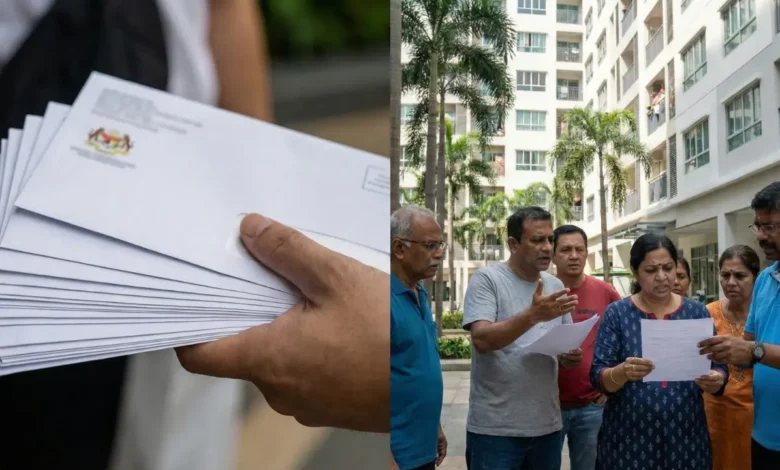

Over two dozen Noida housing societies have received GST notices on maintenance and electricity charges, raising fears of massive tax liabilities, legal confusion, and financial strain for thousands of apartment residents.

-

UP tax department seeks 18% GST on maintenance and electricity charges

-

AOAs face potential tax demands running into crores

-

Residents fear financial burden amid lack of prior clarity

Noida: Several high-rise housing societies in Noida are facing mounting uncertainty after the Uttar Pradesh tax department issued notices demanding Goods and Services Tax (GST) on maintenance and electricity charges collected from residents. The move has sparked widespread concern among apartment owners’ associations (AOAs), with residents questioning how they can shoulder liabilities running into crores of rupees.

Over the past three months, notices have been served to more than two dozen societies, asking them to submit detailed records of maintenance fees, electricity charges, and other facilities such as clubs and gyms. In societies with centralised electricity supply, the department has indicated that these charges may attract 18% GST, along with interest and penalties for past years if non-compliance is established.

This marks a sharp departure from earlier practice. Under both the pre-GST VAT regime and after GST was introduced in 2017, AOAs were generally not required to pay GST on electricity or routine maintenance recovered from residents. However, starting this financial year, tax officials began visiting society offices to examine whether such charges constitute taxable services.

According to Rajiva Singh, President of the Noida Federation of Apartment Owners’ Association (NOFAA), the department is treating electricity charges recovered by societies as part of a “composite supply” bundled with maintenance or renting of immovable property. “Based on this interpretation, GST at 18% is being proposed on electricity charges recovered from residents,” he said.

Singh added that this view contradicts CBIC Circular No. 206/18/2023-GST dated October 31, 2023, which clarifies exemptions under the CGST Act, 2017. AOAs argue that electricity is a pass-through charge and should not be taxed when collected on an actual basis.

Several societies say they were never informed about such tax liability earlier. “Now we are being asked to explain years of collections. Who will pay crores of rupees suddenly?” said an AOA member, requesting anonymity.

The situation has already escalated in sectors like Sector 50, where a society received a notice seeking records for FY 2019–20. With GST, interest, and penalties, potential dues could exceed Rs 1 crore for some societies. RWA committees, supported by NOFAA, have approached GST officials, submitting explanations that the additional 5% electricity charge permitted under the state tariff schedule is meant for administrative expenses, which are not taxable.

Under Uttar Pradesh’s electricity tariff rules, AOAs can recover up to 5% extra over the billed amount to cover costs such as billing, distribution, accounting, and audits. Tax officials, however, are questioning charges beyond this threshold, arguing that societies may not qualify as “pure agents” in such cases.

Similar notices have been issued to societies in Sector 100 and Sector 45, prompting residents to consult chartered accountants and lawyers. What began as an issue for individual societies has now turned into a collective concern, with residents attending meetings in large numbers and even preparing to approach tax authorities jointly.

AOAs maintain that they are not commercial entities and exist only to manage common services. Office bearers hold honorary positions, and any tax demand would eventually be passed on to residents. “The 18% GST cannot be absorbed by societies,” Singh said.

Adding to the tension, the tax department has reportedly begun summoning office bearers personally. NOFAA is now seeking intervention to halt such summons where notices have already been issued, while planning to escalate the issue to the CBIC, Revenue Secretary, or Finance Minister for clarity.

“If required, residents will come together and protest,” said an AOA member. “It is simply impossible for societies to pay such massive amounts.”