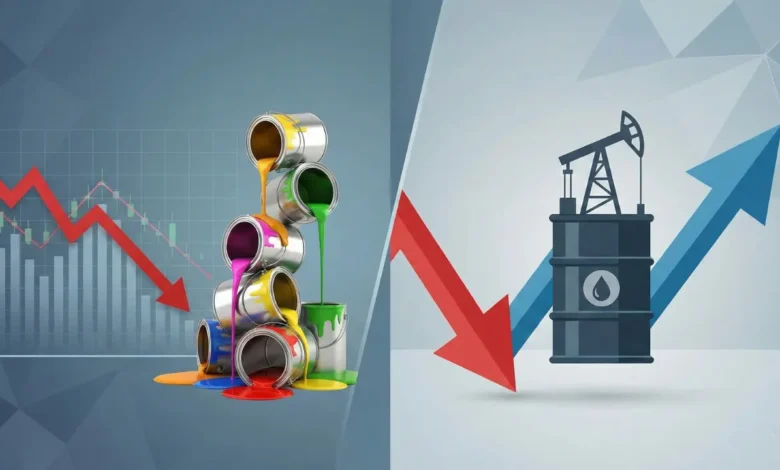

Paint Stocks Fall Up to 2% as Crude Oil Rally Hits Margins

Indian paint stocks weakened as crude oil prices climbed for a fourth straight session, raising concerns over higher raw material costs and margin pressure, with Asian Paints emerging as the top laggard.

-

Asian Paints shares fell over 2%, leading losses in the sector

-

Brent and WTI crude posted their biggest four-day gain since June

-

Rising oil prices raise margin concerns for paint manufacturers

Shares of leading Indian paint companies traded lower on January 14, tracking weakness in broader markets and rising concerns over crude oil prices, a key raw material input for the sector. The sell-off came as global oil benchmarks extended gains for a fourth consecutive session, stoking fears of higher costs and pressure on profitability.

Paint makers are particularly sensitive to movements in crude oil, as derivatives of petroleum are widely used in manufacturing paints, coatings, and emulsions. With India importing nearly 85% of its crude oil requirements, sustained price increases can directly impact input costs, squeeze gross margins, and limit pricing flexibility for companies.

Against this backdrop, Asian Paints shares declined 2.1% to trade at ₹2,826, making it the biggest loser among paint stocks during the session. Indigo Paints slipped nearly 2% to ₹1,198, while Shalimar Paints fell about 1% to ₹67.30. Shares of Berger Paints also remained under pressure, trading 1.5% lower at ₹512.75.

Crude Oil Rally Weighs on Sentiment

Global crude oil prices surged sharply earlier in the week, with both Brent and WTI crude futures recording their strongest four-day rally since June. On Tuesday, Brent crude settled 2.5% higher at $65.47 per barrel, while WTI crude gained 2.77% to close at $61.50 per barrel—levels last seen in early November.

The rally was driven largely by heightened geopolitical tensions involving Iran, one of the top producers within the Organization of the Petroleum Exporting Countries (OPEC). Escalating protests, reports of a government crackdown, and strong remarks from US President Donald Trump raised fears of potential supply disruptions.

Earlier statements from the US administration suggested stricter trade measures against countries doing business with Iran, including possible tariffs. While no formal notification has been issued yet, markets reacted sharply to the uncertainty, pushing oil prices higher.

Temporary Cooling in Oil Prices

Crude prices eased slightly during Wednesday’s session, with Brent and WTI trading lower by around 0.7% and 0.4%, respectively. The decline followed reports that Venezuela had resumed oil exports, with two supertankers—each carrying around 1.8 million barrels—departing Venezuelan waters. These shipments are reportedly part of a broader supply arrangement with the US, which helped calm immediate supply concerns.

Outlook for Paint Stocks

Market participants remain cautious on paint stocks in the near term. Analysts note that if crude prices remain elevated, companies may face margin pressure in upcoming quarters, especially if demand conditions do not allow full cost pass-through to consumers. However, any sustained cooling in oil prices could offer relief to the sector.

For now, volatility in global crude markets continues to be a key factor influencing investor sentiment toward Indian paint companies.