Top 5 Undervalued Real Estate Stocks to Watch in 2025

The Indian real estate sector witnessed a significant upswing through 2023 and into early 2024, fueled by high demand, rising property prices, and swift inventory offloads. However, this bullish phase hit a speed bump by mid-2024 as the broader economy began to slow down.

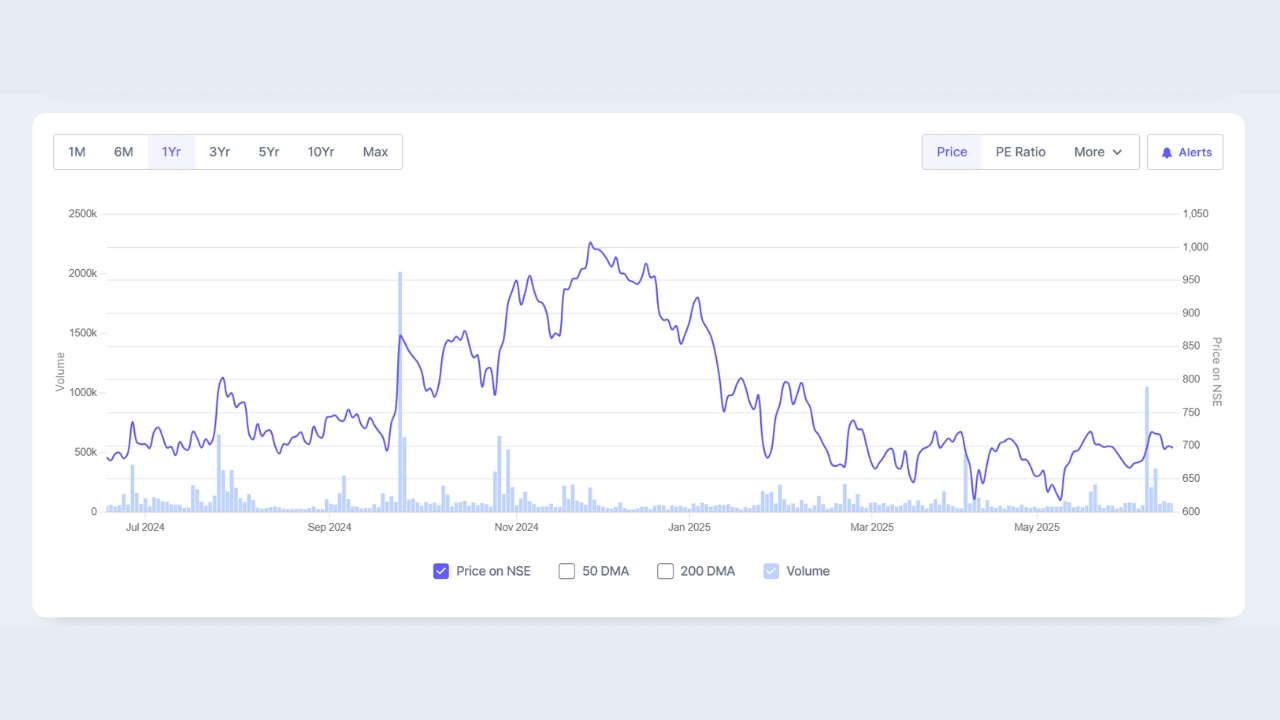

As a result, the Nifty Realty Index dropped steeply — falling 33.8% from its 52-week high of ₹1,157 to just ₹766 in April 2025.

Yet, in a surprising turn, the sector bounced back swiftly. Within just two months, the index surged 31%, propelled by positive investor sentiment amid hopes of continued housing sales and the central bank’s easing interest rate stance.

According to Cushman & Wakefield, the real estate sector’s contribution to India’s GDP is expected to double — from the current 7% to a robust 15% by 2030 — largely driven by increasing urbanization and rising disposable incomes.

Now, while many real estate stocks have regained premium valuations, there are still a few under-the-radar names that remain attractively priced.

Here are five such undervalued real estate stocks worth watching:

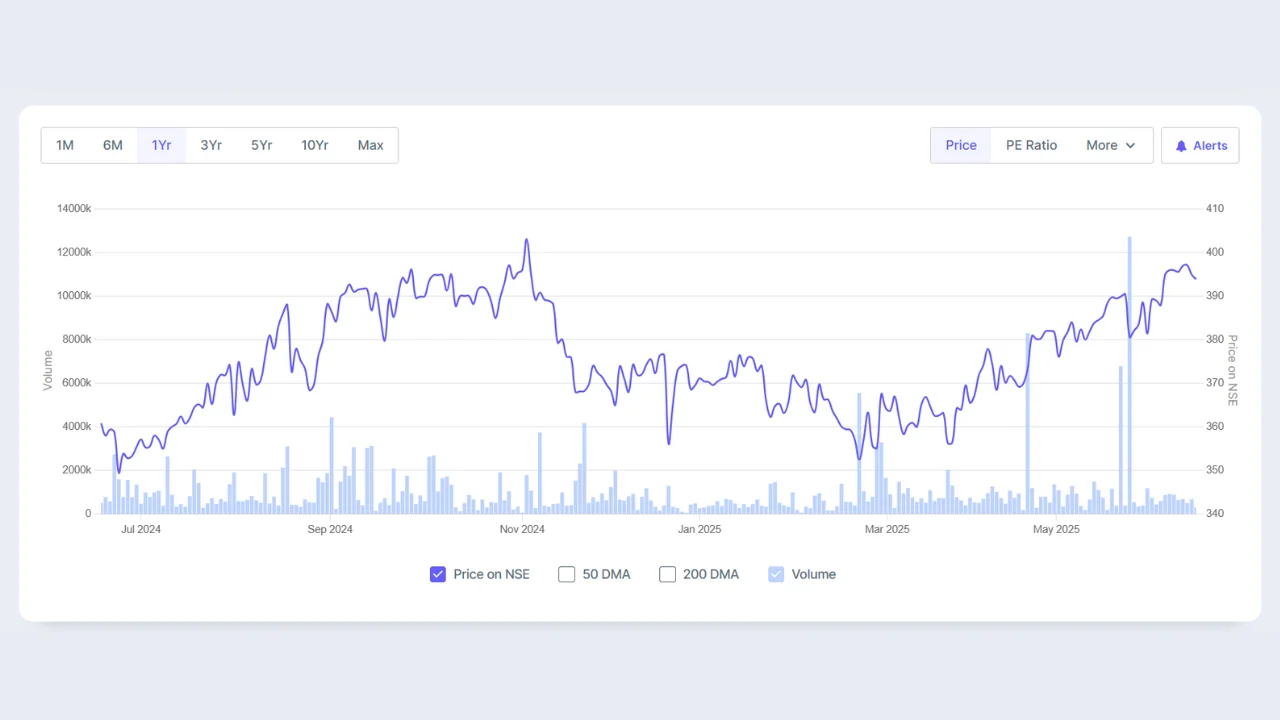

1. Embassy Office Parks REIT

Asia’s Largest REIT by Area

Embassy Office Parks REIT, backed by the Blackstone Group and Embassy Group, is the largest real estate investment trust (REIT) in Asia by floor area. The trust specializes in managing and leasing income-generating commercial properties.

Currently, Embassy REIT owns and operates 14 premium office parks across top Indian cities like Bengaluru, Delhi, Mumbai, and Pune, totaling a portfolio of approximately 51.1 million square feet.

At a PE ratio of just 23, the REIT is trading significantly below both its 3-year average PE of 40 and the broader industry average of 37 — suggesting undervaluation.

Key Financial Metrics (FY25):

- Occupancy Rate: ~91%

- Revenue: ₹40.4 billion (up 10% YoY)

- Net Operating Income: ₹32.8 billion (up 10%)

- Distribution to Unit Holders: ₹23 (yielding ~6% at current price of ₹395)

- Price Gain: 11% in FY25

Embassy REIT plans to develop 6.1 million sq. ft. of new space over the next three years and expects a rise in lease renewals — around 10% of leases are due for expiry — potentially leading to better rental yields.

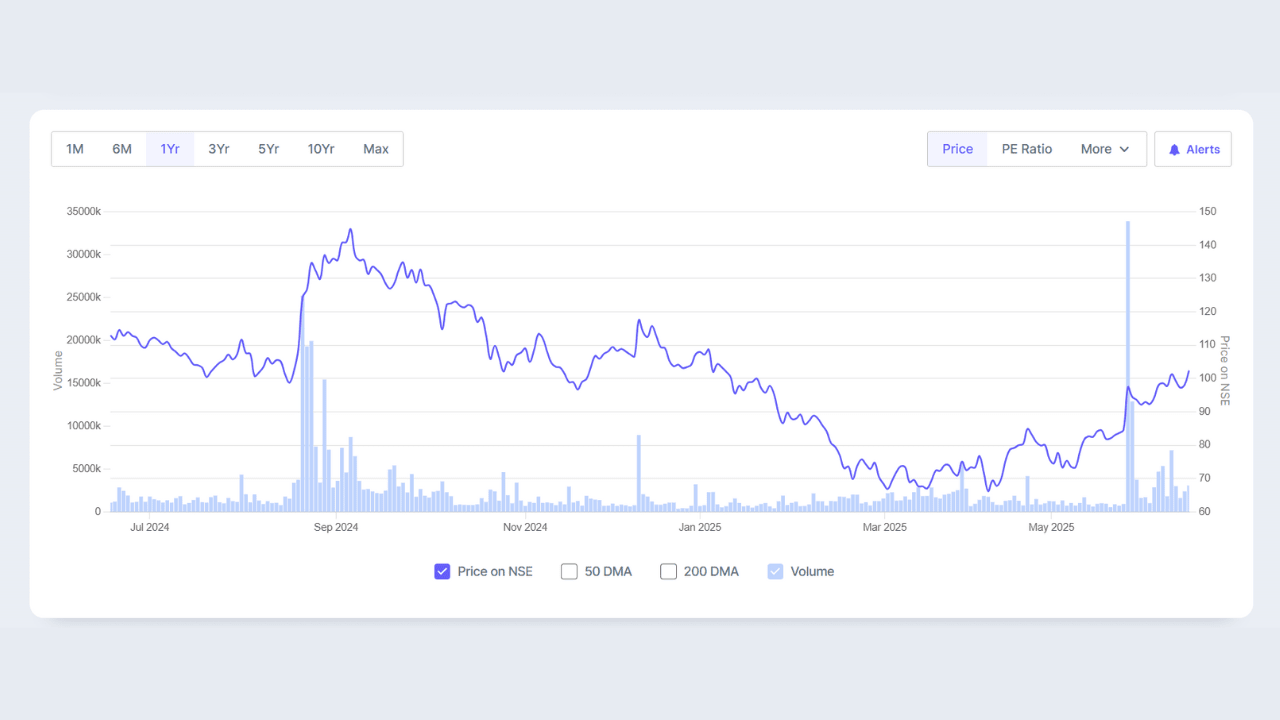

2. Shriram Properties

Affordable Housing Giant in South India

Shriram Properties, part of the Shriram Group, focuses on affordable and mid-income housing in Bengaluru, Chennai, and Kolkata. With over 20 years of experience, it has carved a niche in Southern India’s real estate scene.

Currently, Shriram trades at a PE of 22, slightly below its three-year median of 24 and well under the sector average of 37 — indicating potential upside.

FY25 Financial Highlights:

- Revenue: ₹9.7 billion (down 1.4% YoY due to lower volumes)

- Net Profit: ₹0.77 billion (up 2.5% YoY)

- PE Ratio: 22

The company is banking on a turnaround in FY26, with plans to launch 5–6 million sq. ft. of new projects and a sales target of over ₹20 billion. In addition, about ₹14 billion in revenue is expected from ongoing developments.

Looking ahead, management expects a 44% growth in sales and better margins, supported by price hikes and project completions.

With 36.4 million sq. ft. of planned developments valued at ₹97.7 billion, the company is positioned for strong earnings in the coming years.

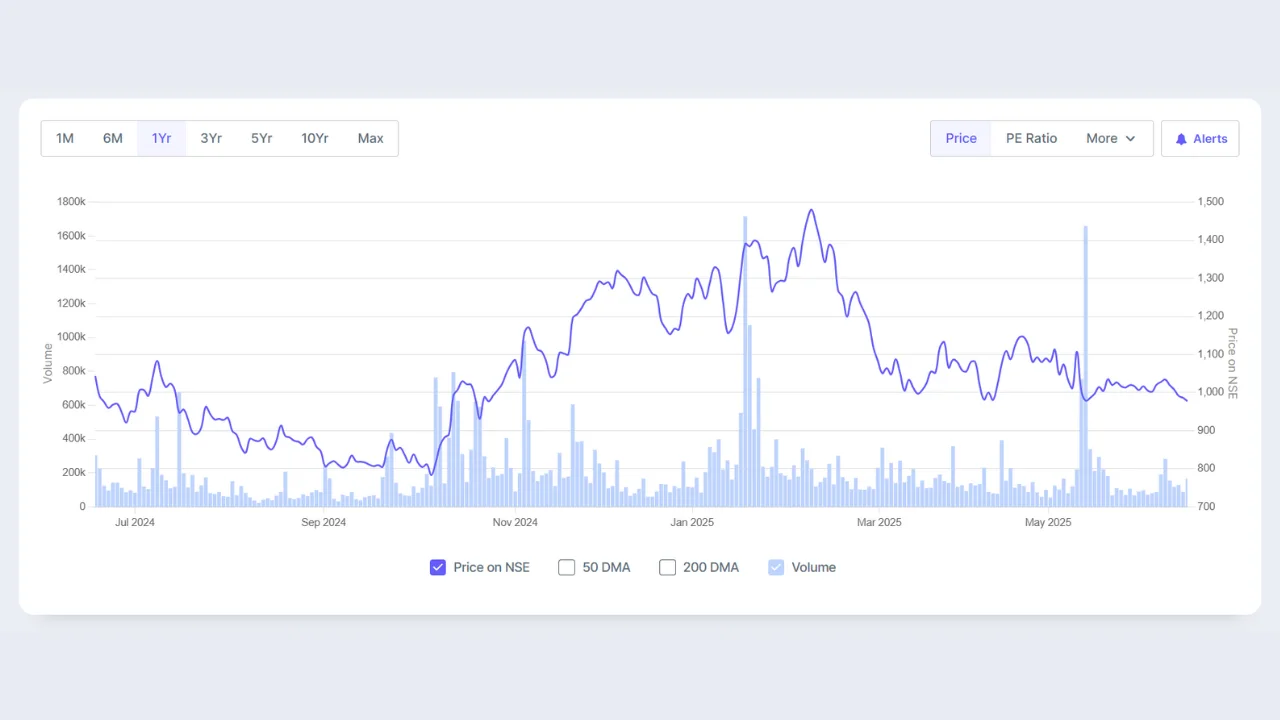

3. Ganesh Housing

Dominant Player in Ahmedabad with a Massive Land Bank

Ganesh Housing is a key developer in the mid-to-premium housing category, expanding steadily into commercial, retail, and township projects. It holds over 500 acres of prime land in Ahmedabad with a development capacity of nearly 40 million sq. ft.

At a PE multiple of 14 — compared to its 3-year median of 18 — Ganesh Housing remains attractively valued.

FY25 Performance Highlights:

- Revenue: ₹993.5 billion (up 11% YoY)

- Net Profit: ₹59.8 billion (up 30% YoY)

- Net Debt-Free: For 11 consecutive quarters

Ganesh Housing is currently executing two flagship projects — Million Minds and Malabar Retreat — with a combined value of ₹13.5 billion.

It also has long-term plans to develop 33 million sq. ft. across various formats, targeting revenue worth ₹173 billion, providing a solid runway for future growth.

4. Kolte-Patil Developers

Residential Powerhouse in Pune Expanding to Mumbai and Bengaluru

Kolte-Patil is a leading name in Pune’s real estate space, holding 8-10% market share. It operates in all segments — from affordable to ultra-luxury — under its Kolte-Patil and 24K brands.

Despite a minor revenue dip of 1% in FY25, the company turned profitable due to higher margins, posting a net profit of ₹1.1 billion after a loss of ₹0.7 billion the previous year.

Valuation Snapshot:

- PE Ratio: 32

- 3-Year Median PE: 43

- Industry PE: 37

Future plans include:

- New Launches: 5 million sq. ft. valued at ₹50 billion

- Presales Target: ₹135 billion from FY25–27

- Mumbai Redevelopment Projects: 14 ongoing, 4 completed

- Current Portfolio: 4 million sq. ft. ready, 8.5 million sq. ft. awaiting approvals

Kolte-Patil is strategically expanding to newer geographies, aiming for 30% of future revenue from outside Pune, especially Mumbai and Bengaluru.

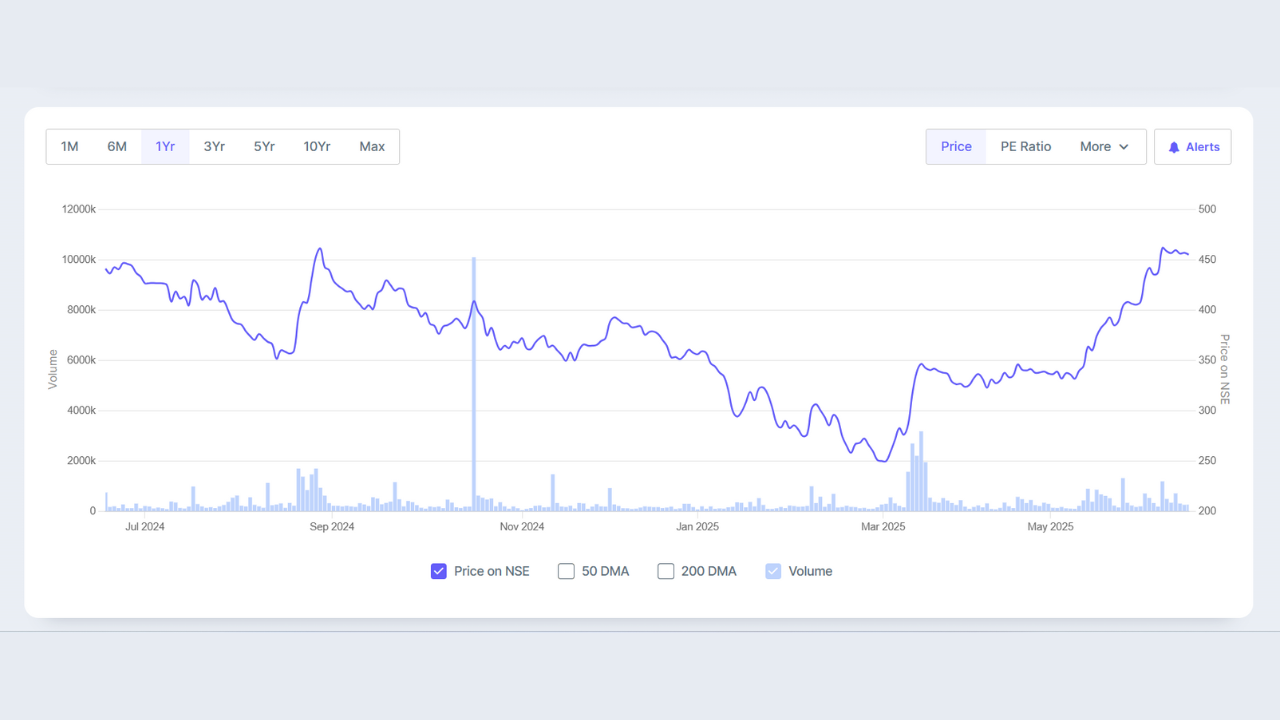

5. Arvind Smartspaces

A Rising Star in Real Estate from the Lalbhai Group

Arvind Smartspaces, part of the Lalbhai Group, has diversified offerings across residential (plots, villas, apartments) and select commercial projects. It caters to both mid-income and affluent customers.

The stock trades at a PE of 30 — markedly lower than its historical average of 58 — signaling valuation comfort despite impressive growth.

FY25 Financials:

- Revenue: ₹7.1 billion (up 109% YoY)

- Net Profit: ₹1.2 billion (up 133%)

The company is ramping up activity across three major cities — Bengaluru, Ahmedabad, and the Mumbai Metropolitan Region — with project launches worth ₹40 billion lined up for FY26.

Arvind Smartspaces also holds ₹14 billion worth of unsold inventory and ₹83 billion in yet-to-be-launched projects. Management projects a 25% annual growth rate through FY27, supported by robust pipeline visibility.

Final Thoughts

The Indian real estate market has proven its resilience by bouncing back quickly from recent economic stress. The sector’s long-term fundamentals — urban growth, infrastructure spending, and favorable demographics — remain intact.

However, short-term challenges like sales normalization, high base effects, and constrained pricing power may cap immediate upside. That’s why investors must focus on companies with sound financials, disciplined execution, and future-ready strategies.

For those seeking consistent long-term growth, the five undervalued stocks above offer a promising mix of value, stability, and upside potential — making them worth serious consideration in a diversified real estate portfolio.

Disclaimer:

Investments in the stock market are subject to risks. Do thorough research or consult a registered financial advisor before investing. This article is for informational purposes only and does not constitute investment advice.