John Abraham Leases Bandra Homes for ₹4.3 Cr Deal

Bollywood Actor John Abraham has quietly made a powerful investment move. The actor has leased out three premium residential properties in Bandra West—one of Mumbai’s most coveted addresses—to enjoy a long‑term rental stream estimated at a robust ₹4.3 crore over the next five years.

Situated in The Sea Glimpse Co‑operative Housing Society, the trio of apartments commands an impressive starting rent of ₹6.30 lakh per month combined—an ambitious figure even by Bandra standards. Following a carefully structured escalation plan, this rental sum will climb to ₹8 lakh per month by the final year of the lease. With an escalation clause of nearly 8% annually for the first two years, followed by 5% in the last two years, the arrangement reflects not just high starting numbers but also a profitable trajectory.

The leasing contracts were officially registered in May 2025, with the documents accessed via Square Yards and government portals. Stamp duty for the deal was calculated at approximately ₹1.12 lakh, with registration charges of ₹1,000. In addition, tenants have placed a substantial ₹36‑lakh security deposit, offering Abraham both security and liquidity.

Over the full 60‑month term, the cumulative rental income—factoring in escalations—comes out to nearly ₹4.3 crore.

Bandra West isn’t just another Mumbai suburb—it’s a lifestyle and investment beacon. Flanked by the Bandra Kurla Complex and supported by strong connectivity via the Western Express Highway, suburban rail, and emerging metro lines, Bandra offers both urban convenience and upscale living.

The neighborhood is home to an illustrious array of celebrities, including Shah Rukh Khan, Salman Khan, Ranbir Kapoor, Janhvi Kapoor, Tripti Dimri, and more. That star power makes Bandra a hotbed for demand from affluent professionals and high‑net‑worth tenants.

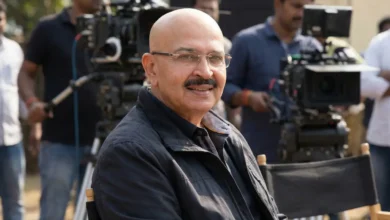

At age 52, Abraham is widely recognized not just for his filmography—blockbusters like Dhoom, Madras Café, and Pathaan—but also for his astute entrepreneurial ventures. He founded JA Entertainment in 2012, producing award‑winning films like Vicky Donor. He also owns NorthEast United FC, runs the Goa Aces racing team, promotes JA Fitness, and has stakes in Subko Coffee Roasters and NOTO Healthy Ice Cream.

This latest real estate play is consistent with his broader strategy: diversifying income sources via non‑film assets. Properties like these offer steady, long‑term cash flow and appreciate over time—an ideal complement to the unpredictability of entertainment ROI.

Structuring for Stability: Lease Terms

- Initial Rent: ₹6.30 lakh/month across all three units

- Annual Escalation: ~8% per annum for years 1–2; ~5% per annum for years 3–4

- Final Year Rent: ₹8 lakh/month

- Lease Duration: 60 months (May 2025–April 2030)

- Security Deposit: ₹36 lakh

- Stamp Duty & Registration: ₹1.12 lakh + ₹1,000

Mumbai’s top-tier suburbs—including Bandra, Khar, Pali Hill, and Juhu—are witnessing an unprecedented resurgence in rental yields. Increased salaried professionals, desiring high living standards and convenience, have driven demand. Reports show that even as property prices have climbed, high‑quality units continue to stand out in rental markets.

Celebrity landlords contribute further cachet—and often command higher rates. Abraham’s deal is a textbook example: well‑located, well‑packaged, well‑priced. Many of his peers—from Shah Rukh Khan to Salman Khan—also own high‑profile properties in the area, but few choose to actively monetize them in such structured lease deals.

- Stable Cash Flow: Estimated ₹86 lakh/year initially, growing to ~₹96 lakh in the final year.

- Passive Income Pipeline: A smart hedge against fluctuation in film‑industry earnings.

- Capital Appreciation: These Bandra properties are likely to rise in value over the next decade.

- Professional Management: With seasoned tenants and formal contracts, management is low‑touch.

Celebrities increasingly view real estate as fertile ground for investment. The precedent is growing: actors own stakes in everything from sports franchises to health startups and luxury real estate. As physical property offers dependable earnings, it’s emerging as a cornerstone in celebrity wealth-building portfolios.

Post‑2030, Abraham has multiple paths:

- Renew Leases at Higher Rates: With Bandra’s reputation firming up, rental increments may jump.

- Sell for Capital Gains: Move circa 2030 in real estate could fetch significantly more than current book value.

- Retain and Expand: Acquire adjacent units or reinvest profits in similar high-end projects.

John Abraham’s Bandra property lease is both a personal financial milestone and a showcase of how celebrity capital can thrive beyond glitz and glamor. Generating ₹4.3 crore in guaranteed rental income over five years, Abraham leverages Mumbai’s premium real estate ecosystem to build steady wealth—on his own terms.

As the film icon continues to explore business avenues—ranging from film production to sports, fitness, and gastronomic ventures—this real estate venture roots him firmly in long‑term asset management. For others in the celebrity fold, the message is unmistakable: Location, legacy, and lifestyle can combine to yield returns far beyond a single blockbuster.